Infrastructural development depicts the growth and success of any region. History is a witness to the evolution of different civilizations and historians have labeled those as the most developed and civilized cities which were meticulously designed and planned with the best construction materials available at that time. Today, too. Infrastructural development is a key to the economic development of any country. Now, building developed and well-planned cities is comparatively easy—Thanks to `Cement’. Cement is a versatile and essential building material used in any modern construction. It ensures the durability of structures by holding coarse aggregates like sand, gravel, and steel. Ever since its invention, cement has been playing a vital role in building a strong nation with well-built skyscrapers and cemented roads. Considering its immense benefits, the cement industry has become one of the main industries necessary for sustainable development and key infrastructure industry. While other building materials have been invented, cement remains an irreplaceable and critical part of construction due to its high strength and durability. It can be considered the backbone for the development of any country.

India is the second largest producer of cement in the world. It accounts for more than 7% of the global installed capacity. India has a lot of potential for development in the infrastructure and construction sector and the cement sector is expected to largely benefit from it. Cement industry is the second most important primary and basic industry in India and has contributed a great deal towards its economic development. It stands second only after iron and steel industry and it has a commendable contribution to the development of the other factory industry, to the construction and even to the development of agriculture. Cement is required by every industry and is an important part of industrial infrastructure. It provides direct and indirect employment to a large number of population and boosts major part of Gross Domestic Product (GDP).

With the adoption of massive modernisation and assimilation of state-of-the-art technology, Indian cement plants are today the most energy-efficient and environment-friendly and are comparable to the best in the world in all respects, whether it is size of the kiln, technology, energy consumption or environment-friendliness.

The cement industry contributes to environmental cleanliness by consuming hazardous wastes like Fly Ash (around 30 Mnt) from Thermal Power Plants and the entire 8 Mnt of granulated Slag produced by Steel manufacturing units and also using alternate fuels and raw materials using advanced and environment friendly technologies.

At present, the Installed Capacity of Cement in India is 500 MTPA with production of 298 Million Tonnes per annum. Majority of the cement plants installed capacity (about 35%) is located in the states of south India. In PAT scheme, Total Installed Capacity of Cement in India is 325 MTPA which contributes to 65% coverage of total installed capacity in India.With the increase in growth of infrastructure, the cement production in India is expected to be 500 Million Tonnes by the year 2020 and 800 Million Tonnes by 2030.The per capita consumption of cement in India is 195 kg which is far less than world average of 500 kg and 1000 kg of China.

India’s cement production in the past five months has jumped 44 per cent on a year-on-yeary(yoy) basis and two per cent as compared to the pre-pandemic April-September 2019 period, to 142 million tonnes (MT), according to a report by rating agency ICRA. The agency expects the pan-India cement production to be up by around 12 per cent to 332 MT in the current financial year and 358 MT in 2022-23.

Based on the trends so far, ICRA expects the all-India cement production to report an increase by around 12 per cent to 332 million MT in 2021-22, which will be supported by the rapid increase in demand in rural housing and the pick-up in infrastructure activity.

As per other market reports it is estimated that about 60% of cement is consumed by the housing sector. Demand is further getting fuelled by the non-trade segment, which is gaining momentum with the resumption of construction work of public infrastructure projects such as roadways and metros, after the lockdown.

In terms of production, South India has the maximum production capacity among the five zones (North, South, Central, West, and East). It has a share of about 33% of the overall cement production.

However, the industry is well diversified over all the states of India since the manufacture of cement requires weight losing materials like limestone or chalk, clay and gypsum, the industry has a tendency to be attracted at the point of minimum transportation costs in relation to raw materials. Limestone of excellent quality exists in abundance in many parts of the country, and in close proximity of railway lines so that industry shows a tendency of regional dispersal of production activity. Given the enormous need for infrastructure and housing, which require large quantities of cement as a basic building block, the prospects of the industry are bright. This has been endorsed by market developments such as mergers and acquisitions by both domestic and international players.

Cement industry has made tremendous strides in technological upgradation and assimilation of latest technology. At present ninety three per cent of the total capacity in the industry is based on modern and environment-friendly dry process technology and only seven per cent of the capacity is based on old wet and semi-dry process technology. There is a tremendous scope for waste heat recovery in cement plants and thereby reduction in emission level. One project for co-generation of power utilizing waste heat in an Indian cement plant is being implemented with Japanese assistance under Green Aid Plan. The induction of advanced technology has helped the industry immensely to conserve energy and fuel and to save materials substantially.

India is also producing different varieties of cement like Ordinary Portland Cement (OPC), Portland Pozzolana Cement (PPC), Portland blast Furnace Slag Cement (PBFS), Oil Well Cement, Rapid Hardening Portland Cement, Sulphate Resisting Portland Cement, white Cement etc. Production of these varieties of cement conform to the BIS Specifications. It is worth mentioning that some cement plants have set up dedicated jetties for promoting bulk transpiration and export.

The eastern states of India are likely to be the newer and untapped markets for cement companies and could contribute to their bottom line in future. In the next 10 years, India could become the main exporter of clinker and gray cement to the Middle East, Africa, and other developing nations of the world. Cement plants near the ports, for instance the plants in Gujarat and Visakhapatnam, will have an added advantage for export and will logistically be well armed to face stiff competition from cement plants in the interior of the country. India’s cement production capacity is expected to reach 550 MT by 2025.

Due to the increasing demand in various sectors such as housing, commercial construction and industrial construction, cement industry is expected to reach 550-600 million tonnes per annum (MTPA) by the year 2025.A number of foreign players are also expected to enter the cement sector owing to the profit margins and steady demand.

Cement will play a major role in the development of 98 smart cities providing a major boost to the sector. Aided by suitable Government foreign policies, several foreign players such as Lafarge-Holcim, Heidelberg Cement, and Vicat have invested in the country in the recent past. A significant factor which aids the growth of this sector is the ready availability of raw materials for making cement, such as limestone and coal.

India’s overall cement production accounted for 294.4 million tonnes (MT) in FY21 and 329 million tonnes (MT) in FY20. Cement production reached 329 million tonnes (MT) in FY20 and is projected to reach 381 MT by FY22. However, the consumption stood at 327 MT in FY20 and will reach 379 MT by FY22. The cement production capacity is estimated to touch 550 MT by 2020. As India has a high quantity and quality of limestone deposits through-out the country, the cement industry promises huge potential for growth.

As per ICRA (Rating Agency), in FY22, the cement production in India is expected to increase by ~12% YoY, driven by rural housing demand and government’s strong focus on infrastructure development. As per CRISIL, the Indian cement industry is likely to add around 80 million tonnes (MT) capacity by FY24, the highest since the last 10 years, driven by increasing spending on housing and infrastructure activities. Higher allocation for infrastructure –34.9% in roads, 8.7% in metros and 33.6% in railways in budget estimates of FY22, over FY21, is likely to boost demand for cement.

According to CLSA (Institutional Brokerage & Investment Group), the Indian cement sector is witnessing improved demand. Key players reported by the company are ACC, Dalmia and Ultratech Cement. In the second quarter of FY21, Indian cement companies reported a sharp rebound in earnings and demand for the industry increased, driven by rural recovery. With the rural markets normalising, the demand outlook remained strong. For FY21, CLSA expects a 14% YoY increase in EBITDA in the cement market for its coverage stocks.

According to the data released by Department for Promotion of Industry and Internal Trade (DPIIT), cement and gypsum products attracted Foreign Direct Investment (FDI) worth US$ 5.28 billion between April 2000 and June 2021.

Pandemic paved the way for working remotely. This resulted in the rise in demand for affordable houses. With ticket size below Rs. 40-50 lakh is expected to rise in Tier 2 and 3 cities, leading to an increase in demand of cement. Private equity investments in real estate surged 24% YoY to US$ 477 million between July 2021 to September 2021.

As per NCB (National Council For Cement and Building Materials), it’s high time to rethink about manufacturing responsibly’ and ‘building right’. For this, the industry must support start-ups also which are coming with breakthrough and disruptive technologies. Such new technologies if supported in time by the industry might turn out to be a game changer in reducing the much talked about CO footprint of the industry. Cement industry has been working on four principles of sustainability viz continuous improvement of environmental profile by reducing emissions and becoming more energy efficient; principle of what is good for environment is also good for business; earning the right to operate from society; and the belief to take the society along with the industry. NCB is also carrying out research studies to maximize the utilization of red mud in industry.

The industry plays a pivotal role in Circular Economy concept in our country by utilizing wastes of other industries. The cement industry has also sharpened its focus on the utilization of alternative fuels by increasingly using newer industrial, municipal and agricultural wastes. There is a substantial scope to enhance waste utilization, particularly hazardous and combustible wastes, and the industry is soon expected to achieve international best practices of waste utilization.

The industry believes that there would be a surge in demand due to the requirements of a strong infrastructure framework that the nation endeavours to put in place through its government as well as housing projects. The demand for the housing segment is expected to grow at 6% per annum’ through the PPP model (Public Private Partnership). As a result, the per capita cement consumption in the country is expected to rise from 225 kg in 2018 to 435 kg by 2030.

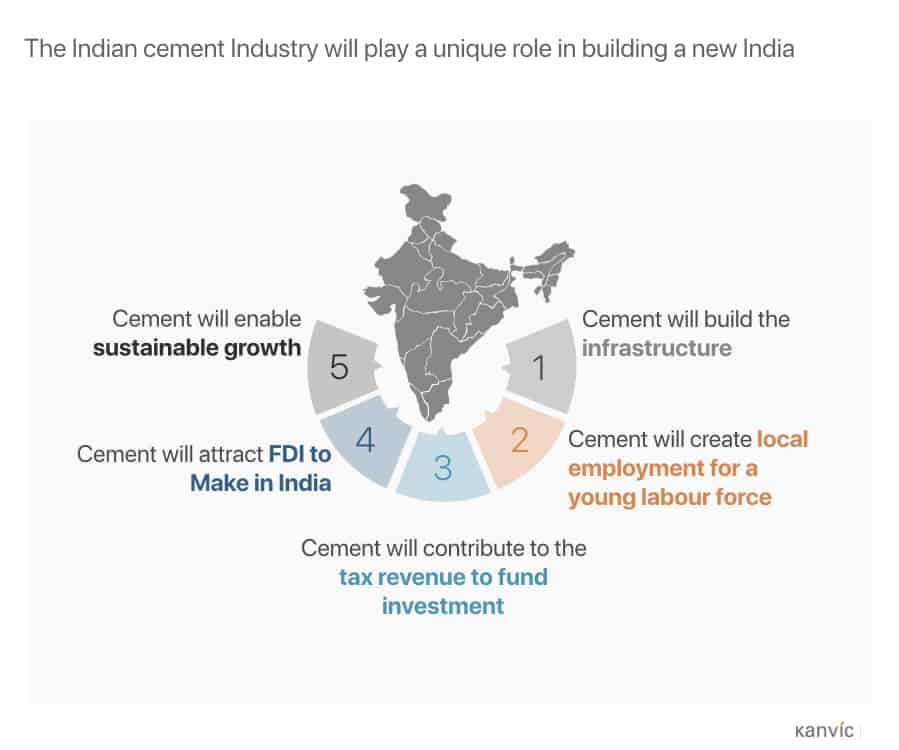

As per Kanvic (a consulting firm) focussing on the mission 2030 the Indian cement industry should make substantial investment in new greenfield capacity, embrace industry 4.0 and adopt more sustainable technologies. By 2030 India will be the world’s most populous nation and its third-largest economy. The country will undergo a unique and unparalleled transformation.

This transformation would bring along huge challenges that will have t be shouldered by the Indian cement industry. But as they say challenges also bring opportunities, thus Indian cement industry can be a partner for building a new India. This would need the industry to go beyond business as usual by adopting new shared vision for the industry and work with the entire ecosystem to Build More, Build Well and Build Right.

The Indian cement industry would play a crucial role in building a new India by contributing towards creating the infrastructure that drives growth, generating employment, contributing tax revenues, attracting foreign direct investment (FDI) in manufacturing, and ensuring environmentally sustainable development.

In the approaching years cement based infrastructure development will provide a major support to the high-level of broad-based GDP growth that India requires to lift the livings standards of a rising population. The cement industry will generate much needed skilled employment across the country, particularly in areas away from large cities that currently suffer from a lack of good job opportunities.

The high level initiatives by the Government in the coming years to build a new India will be dependent on robust revenue streams and it will boost the cement industry’s strong long-term growth. It will be a major attraction for FDI given the necessity to locate cement production close to the sources of demand. The cement industry is the third largest contributor of tax revenues. Thus, a growing and successful cement industry plays a vital role towards financing a better future for the country.

With the latest trend focussing on sustainability, new India needs to be built sustainably if it is to deliver a better future for coming generations. In its position as both a major contributor of CO2 emissions but also a global leader in energy efficiency, Indian cement can be a beacon for best practice to other industries as the country strives to achieve its ambitious commitments to the Paris Agreement on Climate Change.

The future growth will be driven by increased infrastructure spending, as market leaders expects the share of cement demand to rise from 22% today to around 31% in 2030. As per Kanvic the demand for cement from infrastructure will grow at around 10% through to 2030 with the fastest growth coming from the Government’s ambitious Sagarmala programme. At the same time, roads will remain the biggest single source of cement demand from infrastructure as a result of the implementation of the Bharatmala programme and increasing adoption of concrete roads.

Although declining in share from around 60% today to 54% in 2030, the residential sector will continue to be the single largest contributor to cement demand. Housing’s demand for cement will continue to rise at close to 6% per annum as India’s population becomes increasingly urbanised and household size steadily falls. At the same time, the Government’s major push on `Housing For All’ will stimulate near-term growth, particularly in rural housing.

Along with the shift toward infrastructure, the industry will also witness a move toward institutional and ready-made concrete (RMC) customers who predominantly buy in dry bulk rather than bag. This promises to shift the bargaining power from manufacturers to customers but also bring efficiency and cost savings for cement companies.

The regional make-up of cement demand will also evolve by 2030.The traditional regional drivers of cement demand like South will see a recovery in the coming years and the East will continue to see high growth but Central will moderate.

As per Kanvic the Indian cement industry will need to invest in 368 MMT additional capacity – an increase of 83% in order to meet the future demand for cement in 2030. This will not only require setting up new plants but also acquiring adequate land, securing raw material supplies and hiring additional talent.

At the same time, the cement industry must collaborate with the construction sector to improve its performance in areas like air pollution. This will prevent the increasing prohibitions on building activity in India’s cities that are dampening growth.

Kanvic also expresses the need to accelerate the positive steps already taken in infrastructure development. While road construction has accelerated under the Bharatmala initiative and the ambitious Sagarmala programme is underway, India still suffers from a large and persistent infrastructure deficit that will require $4.5 trillion investment by 2040. To illustrate this point, India’s infrastructure to GDP ratio remains around 5.8% while China has consistently invested at levels above 8%.cement companies must upgrade their know-how and product range for the coming wave of construction and design innovation – from 3D printing to factory-based pre-fabrication.

To add to growth story of India Indian cement industry will need to embrace industry 4.0 and digitalise their business. From tracking vehicles at the quarry to remotely monitoring the performance of completed concrete structures, digital can take cement to the cutting-edge. However, to realise its full potential, the industry also needs to promote the rapid digitalisation of the entire construction ecosystem.

The cement industry needs to work together to change how young people see the industry by developing a clear value proposition to attract future talent. In parallel, the industry needs to invest in upgrading the existing workforce for the digital era and end the outdated dichotomy between skilled and unskilled labour.

Kanvic suggests to `build well’ and stresses on the need of Research & Development (R&D) roadmap to avoid falling behind in product innovation, operational efficiency, and sustainability. Today, India accounts for less than 2% of patents filed in cement and concrete compared to 57% from China. By investing more in R&D, funding Ph,Ds and establishing centres of research excellence for cement, the industry can begin to add to add t nation’s growth story.

Cement manufacturing has changed dramatically in India in the last twenty years. It is essential to upgrade the knowledge and skills of the workforce in order to keep pace with the changes in cement manufacturing technology, machinery and input materials, and to tackle new process-related problems that may arise. Further, the sector’s future will demand additional technical workers at all levels trained in the operation and management of modern cement plants. Considering this, there is a need to collaborate with academia and institutions to enhance skills and initiatives and policy support from state and union governments are essential for its success.

Finally, it can be said that to achieve Vision 2030 the Indian cement industry needs to transform its public awareness by bridging gaps and communicating more efficiently with the society. Following pioneers, like NASSCOM (IT), Kanvic suggests the cement industry to speak with a common voice to raise awareness of its vital role in job creation, skilling, social development, innovation, and sustainability.

Government Schemes for the cement industry

(In order to help private sector companies thrive in the industry, the Government has been approving their investment schemes. Some of the initiatives taken by the Government late are as below )

- In October 2021, Prime Minister, Mr. Narendra Modi, launched the ‘PM Gati Shakti – National Master Plan (NMP)’ for multimodal connectivity. Gati Shakti will bring synergy to create a world-class, seamless multimodal transport network in India. This will boost the demand for cement in the future.

- In July 2021, the government established a council of 25 members (comprising UltraTech Cement MD Mr. K C Jhanwar, Dalmia Bharat Group CMD Mr. Puneet Dalmia) for the cement industry to reduce waste, achieve maximum production, enhance quality, reduce costs and encourage standardization of products.

- In Union Budget 2021-22, the Government of India extended benefits, under Section 80-IBA of the Income Tax Act, until March 31, 2021, to promote affordable rental housing in India.

- As per the Union Budget 2021-22, the government approved an outlay of Rs. 1,18,101 crore (US$ 16.22 billion) for the Ministry of Road Transport and Highways, and this step is likely to boost the demand for cement.

- As per the Union Budget 2021-22, National Infrastructure Pipeline (NIP) expanded to 7,400 projects from 6,835 projects.

- The Union Budget allocated Rs. 13,750 crores (US$ 1.88 billion) and Rs. 12,294 crores (US$ 1.68 billion) for Urban Rejuvenation Mission: AMRUT and Smart Cities Mission and Swachh Bharat Mission, respectively, and Rs. 27,500 crores (US$ 3.77 billion) has been allotted under Pradhan Mantri Awas Yojana.

Brief history of cement in India

Cement industry entered very late in India. Though the first cement factory of India was established in 1904 in Madras but industry can be said to begin in the year 1912-13, when three cement factories were established at Porbandar (Gujarat) Katni (M.P.) and Bundi (Rajasthan).

The First World War gave the industry tremendous impetus as the demand for cement for war purposes shot up .Its production rose enormously from 945 tonnes in 1914 to 84,300 tonnes in 1918. The Indian cement manufacturers’ association was formed in 1926 with a view to restricting the output and regulating the sale of cement.

In 1936, Associated Cement Companies limited (ACC) was formed by the merger of 10 principal cement companies. Dalmia Group factories were established with an installed capacity of 5 to 7.5 lakh tonnes a year in 1937. Post partition, the number of cement manufacturing factories was 23 with a capacity of 2.2 million tonnes. Five of them fell in the jurisdiction of Pakistan, the other 18 remained in India, with an annual capacity of 1.5 million tonnes.

As the country witnessed the planning era in the year 1950-51, the cement manufacturing capacity increased to 3.28 million tonnes . During planning period, the cement industry recorded continuous growth. At the end of the Seventh plan India became self-reliant and also started exporting cement. After the complete decontrol of price and distribution on March I, 1989, and introduction of other policy reforms, the cement industry has progressed rapidly both in capacity/production and production process technology. As on April 30, 2003, these were 124 large cement plants with an installed capacity of 140.02, million tonnes per annum.

The cement production during 2002-03 was 116.35 million tonnes with a growth rate of 8.84%. All restrictions on cement prices and distribution were removed on March 1, 1989, under New Industrial Policy Resolution 1991 and the cement Industry was made license free. Export of cement was 6.92 million tonnes in 2002-03. Improvement in the quality of Indian cement has found its ready markets in Bangladesh, Indonesia, Malaysia, Nepal, Middle East Countries Burma, Africa, and South East Asian countries.